My name is Kristi Sullivan and I have been helping people achieve financial security since 1996. I am a fee-only financial planner and public speaker. I do no investment or insurance sales for commissions. My clients pay me for guidance through their financial questions. I also work with employers to educate their employees about personal finance.

I have been helping people make financial decisions for 18 years. I have worked in employee benefits and with individual clients/families. I hold the Certified Financial Planner designation. Sullivan Financial Planning, LLC is a Registered Investment Advisory firm with the State of Colorado. Areas of expertise include prioritizing savings goals, investment allocation, and wealth manager searches.

I can’t believe how this year has flown. Already, we are starting to look back at 2025 and pundits are trying to predict how the year will end up in the stock market. As always, I provide this list as just a, “huh, that’s interesting,” blog. Not as advice to pile in or panic-sell out…

How inconvenient that so many tax deadlines occur at year-end. What you really want to be doing is shopping, egg-nogging, New-Year’s-Eve-smooching, and wearing ugly holiday sweaters while watching football. So, what are some things you can do now, to avoid the crunch of December 31st money tasks? Execute your charitable gifting plans. There is no…

Remember the excitement of back-to-school season? New clothes, Trapper Keepers, and the chance to break out of your previous nerd persona? It never really worked for me, but there was always the dream. Why not recreate that feeling as an adult? They say September is the Other New Year – a chance to dust of…

Wait, is Kristi telling me I shouldn’t donate money to help others? Never! I love charitable gifting and helping clients feel comfortable donating to non-profits. However, often writing a check is the least beneficial to the donor for tax savings. Consider these methods first: Donating Long-Term Appreciated Assets Gifts of long-term appreciated stocks, bonds, or…

An element of retirement income planning that never ceases to confuse is taxes. Accounting for your tax bill as a retirement expense is important. Over-or-under estimating the cost can lead to errors in a retiree’s monthly spending targets. The biggest misconception is that your marginal tax bracket is the amount you pay on all of…

When I have a captive audience of young adults, I like to ask them what concerns them about their personal financial situation. The number one answer (consider this unscientific anec-data) is how to afford a first time home purchase. First, the problem (hint, it’s NOT avocado toast) High home prices and elevated interest rates Incomes…

I am a fan of (at least considering using) reverse mortgages. Although there is some controversy from the old days where the product lacked current consumer protection, the new world of reverse mortgage is worth looking at. Nationwide data indicates that home equity can account for 50% or more of total net worth for many households…

Just when you thought you’d seen it all, a new type of scam has come up where people are impersonating financial planners. I guess impersonating police officers got too boring. You may have noticed that financial advisors’ careers aren’t cast in stone. We change firms, start firms, go into partnerships, leave partnerships, and hire new…

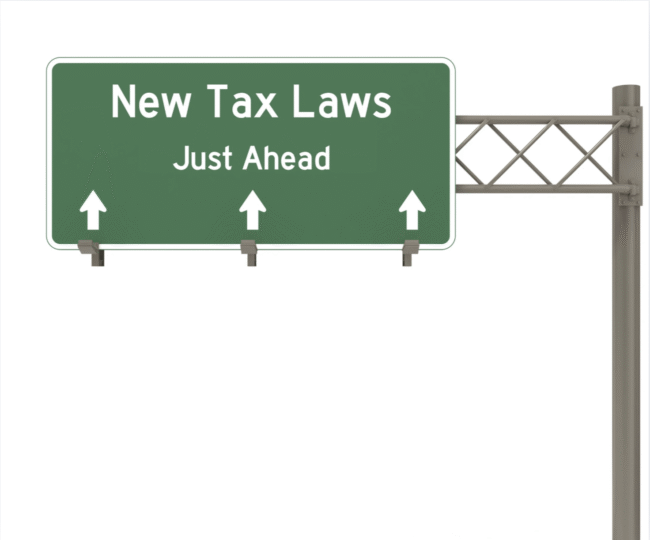

It feels unoriginal, but what kind of financial planner would I be to not even acknowledge the latest tax bill? There is a LOT going on with the bill (remember, it’s Big), so I’m going to focus very narrowly on the items that affect my clients’ financial plans: Social Security, tax rates, and estate provisions.…

Tariffs, world unrest, inflation, politics, actual ticks – things are going to happen, but people still want to finish their basements. A common question that comes up in financial plans is, “How can I pay for my house improvements without derailing my retirement/college goals?” Here are a few ideas: Savings: Using your own cash is…