Am I worried about the upcoming election? Sure, who wouldn’t be? No matter where you sit on the political spectrum, you likely think your guy not winning spells the end of the country.

That’s not my particular worry. The US has survived bad presidents before, and it will again. No, my concern is how investors (my clients and everybody else) will react to the election. If you are reading this and went to cash in 2016 and are STILL sitting in cash because you are still waiting on the red Bat phone to ring to tell you to start investing again, you know what I mean.

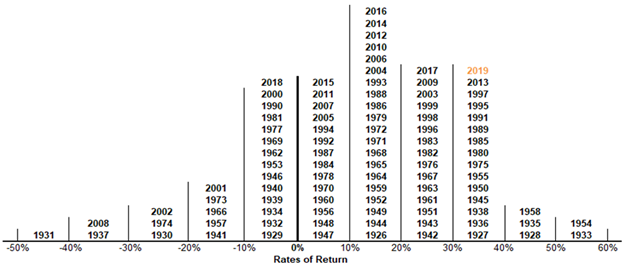

I can lecture you all day about how often we have presidential elections (it’s every four years, or about 22 times in a 90-year lifetime). I can tell you how the US stock market has risen more times than dropped (see chart by Russell investments). I can inform you that investment returns are about the business cycle and not who is sitting in the Oval Office.

Years of experience have taught me that sermonizing grownups with my vast wisdom is as futile as trying to keep teenagers from making their own mistakes. It’s more effective if one comes to conclusions on his/her own.

Here is a quick set of questions to ask yourself before making investment decisions based on an election (or a pandemic or civil unrest or war or bad weather or locusts or…)

- Do you agree that the US economy generally, over history has moved in an upward direction?

- Do you believe that most individuals can repeatedly get out of the stock market when it’s highest and get back in when it’s lowest? Do you feel you are better than most individuals at predicting those highs and lows?

- If you plan to sell your investment because of (pick one) the election, COVID, civil unrest, do you have specific indicators that that will tell you when to invest in the stock market BEFORE it starts to go up?

- What is your time horizon for this money? Do you think the stock market will be higher in (answer to the previous question) years than it is today?

- Do you enjoy actively trading your investments? Does it make you feel confident or worried?

There is no score or right answer here. Just a guide for introspection on whether you should make big investment changes based on the crisis du jour. Remember, there is always another election, panic, disruption, weather event, or alien invasion around the corner. History has shown those who do not try to avoid the pain of recessions have more money than those that do.