Let’s start off with a direct quote for how the October 2021 version of this blog started: “I guess it’s a good year in the stock market when the worst performing sectors (so far, as of writing this blog on September 13th) aren’t negative, just not up as high as the best performers. My sage advice for acting on this data – don’t get used to it!”

How prescient I must seem looking back. A very different picture confronts us in 2022.

Here, with no particular plan for you to act on the information, are the best and worst performing sectors as of 75% through 2022. For fun, you can contrast these with 2021 numbers by clicking back in time.

2022 Best:*

Energy: Up 30.22%

Utilities: Up 8.46%

Retail: Down 6.77%

Consumer non-Cyclical: Down 9.37%

Capital Goods: Down 13.06%

Financial: Down 13.67%

That’s right dear readers, 4 of the 6 BEST returners are firmly in the negative for the year. Wooooo, creepy. No, really, it stinks.

2022 Worst:*

Technology: Down 27.51%

Consumer Discretionary: Down 25.24%

Conglomerates: Down 23.56%

Services: Down 16.65%

Basic Materials: Down 15.75%

Transportation: Down 15.72%

The S&P 500 (representing the 500 largest US stocks by market capitalization) is down 17%. The bond market as represented by the Barclay’s Aggregate Bond Index is down 12%. The MSCI EAFE index (a measure of developed international bonds) is down 19%. Bet you are not feeling great about diversification just now, huh?

Yes, it’s a chilling year for this column. Scared, angry jack-o-lantern carvings all around the neighborhood.

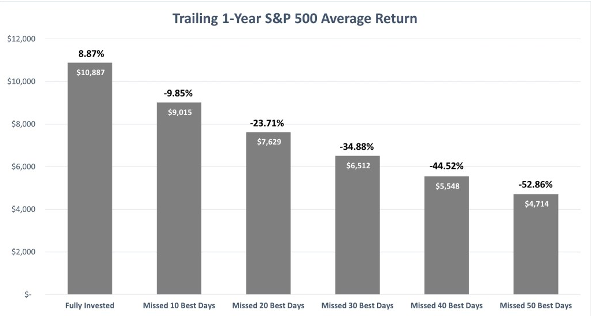

What’s really scary is the thought of my newsletter readers bailing out of their investments, sitting in cash, and waiting for a sign that investments are about to skyrocket back up (maybe Snickers to start raining from the heavens) to get back in.

Please, remember this chart before making any rash moves.

*Source – and this will be more up to date if you click now: https://csimarket.com/markets/markets_glance.php?days=ytd

Now, go drown your sorrows in candy corn!