Some people really want to retire. Umbrella drinks on the beach, unlimited time to knit, tee times during non-peak hours, and never skiing on a weekend again. Sounds great, right?

Not for everyone. More and more, clients tell me they don’t really want to retire. After all, retirement is what old people do, and most of us are reluctant (at any age) to admit that we are old. “Retired” is not the word, then. Financial independence sounds better.

What does financial independence look like? It’s hard to work for what you can’t define. What about these?

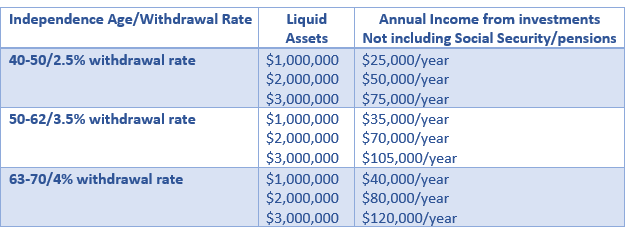

Your money works for you, instead of you working for your money. This could mean you have enough liquid investments to provide income without earning it. Well, how much is that? See my handy chart:

Your money works for you instead of you working for your money (Part Two). This may mean a portfolio of rental properties with enough profit to support your lifestyle.

You no longer have any debt or large expenses looming. Someone who has paid off their mortgage and launched their children could feel less pressure to work for a high income. You are not necessarily leaving the workforce but can scale down work or change careers to something more fulfilling.

Your expenses are small enough and you have saved enough to work half time. Or for only one spouse to work at a time if you have previously relied on two incomes.

You have a hobby that you can monetize. That, coupled with your savings, would be enough to support your lifestyle.

What is your vision to set off the fireworks and celebrate financial independence?