Ugh, September is one of those months with FIVE Thursdays. That’s a lot of blogs to write so I’m taking a breather this week and re-running a Blog from July 2022 about risk tolerance and stock market drops.

The financial services industry has for years been collectively handwringing about how to measure clients’ real feelings about stock market volatility. The problem starts with the language we use. It continues with the overconfidence of people when markets are good.

When the stock market is climbing, everyone is an investing genius and has no fear of failure. Clients consistently self-report a high risk tolerance when asked about volatility.

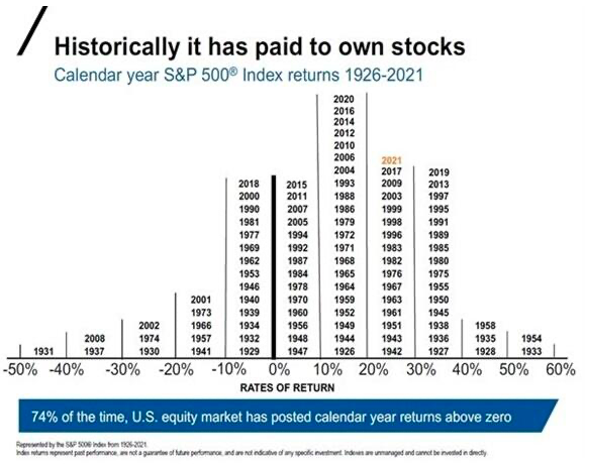

Stock market volatility is just a fancy way of saying “losing your money.” Yes, the word volatility implies ups and downs, which the stock market has plenty of. In fact, there are more ups than downs historically.

Obviously, everybody likes the ups, so let’s forget about that part. What we need people to own up to is how they will react to the downs. Again, the trick is in the words we use. If I ask you whether you are comfortable with your portfolio losing 10% while the overall stock market lost 20%, you might say you are satisfied with that result.

However, if you have a $1,000,000 portfolio and you lose $100,000 due to a freak pandemic, I promise, your feelings are far from happy. Even if the rest of the market is down 30%, your 10% is now real money ($100,000) and you want relief from the pain.

March 2020 stock market results were very scary for some, but were they scary enough? By the time many clients got around to calling me, their portfolios were back up to near highs and they felt better. Granted, some people did internalize the short-term investment pain and made changes to buck up their cash reserves or maybe shift to a more conservative allocation going forward. Those who went all to cash when their balances had lost 20% are still down 20% because they missed the very short window when stocks came roaring back.

By the way, another little language lesson: When you tell your financial advisor that you want to (or have already) “move to cash until things get better,” what you are really saying is, “I want to sell low and buy high, therefore locking in consistently lower-than-inflation returns.”

What is the solution? Better communication helps solve many problems of the world, whether in the dining room, conference room, or the Oval Office. The next time your investment advisor asks you how much loss you can take in your portfolio, try communicating it in dollars, not percentages. The portfolio you receive may be much more conservative (read, less growth), but you will sleep better during the rough times.

I hope you enjoyed this trip down memory lane.