I’ll try to make this concise: This clamor for Bitcoin/Game Stop/SPAC returns and shunning of traditional investment portfolios is nothing new. See my 5 Famous Bubbles Blog for a reminder.

What seems to get lost in all the clamor of investing for the biggest returns (damn the torpedoes, etc.), is WHY are those returns necessary? If you can make it to your retirement, college, or house down payment goals without your money making 50% in a year (and likely losing more than that just as fast), why not take the Ferris Wheel and skip the Tower of Terror?

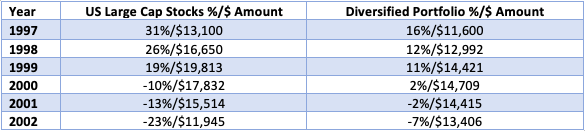

A Tale of Two Portfolios: $10,000 invested in 1997-2002*

In this snapshot, the average rate of return on US Large Cap Stocks was 5% while the Diversified Portfolio was 5.3%. Not a huge difference in percentages, but a decent amount higher of dollars in the account.

I’m trying to emphasize flashy returns don’t always lead to having more money. The Diversified Portfolio will NEVER make as much in a year as the hottest investment category. But you will usually end up with more money by being diversified over the long haul.

Here is a little peek behind the curtain of the mysterious world of investment management. When you are asking your financial advisor about why you aren’t in Bitcoin, as they are grinding their teeth, they are thinking about this chart. And whether they can withstand another fad in the investment management business before retiring with their diversified portfolios to Costa Rica.

*Source, seekingalpha.com, Charting Asset Class Returns from 1995 – 2009