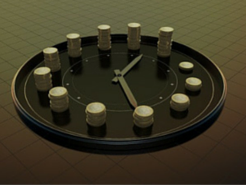

One question I help people answer in retirement planning is when to take Social Security. A couple of reminders on the rules:

- You can take Social Security as early as age 62, but your amount will be lower than if you waited until your full Social Security age.

- For most people considering the question today, full Social Security age is between 66 and 67 years old.

- If you wait beyond full Social Security age to take your benefit, the amount you will get goes up 8%/year until age 70. After age 70, the benefit does not increase, so you may as well take it.

Now, if you haven’t saved very much for retirement, there is no question about when you should take Social Security. You will take it as soon as you stop working. Otherwise, you’ll run out of savings very soon.

If, however, you have a nice cushion put aside, you have some options. I’ve found when running retirement projections that waiting to take the larger benefit at age 70 often results in better outcomes (aka more money left at life expectancy). This allows retirees to have a higher budget throughout retirement.

Ironically, though, being told to spend more out of savings in the first years of retirement (while they are waiting to take Social Security) makes many people uncomfortable. When faced with taking all of the budget out of savings for a few years, many retirees will spend less than the projections allow.

So, what’s the answer?

Have a financial planner (hopefully me!) run the numbers for you. Then use that knowledge, along with what makes you comfortable, to create an income plan that is right for your retirement years.

If these topics sound like they would be of interest to your employees, sales conference, or professional organization, contact me at 303-324-0014 or kristi@