A term we financial planners throw at our clients a lot is Asset Allocation. What does that even mean? Well, it’s only the most important decision you make with your investments!

Asset Allocation

Asset Allocation is simply the percentage of your money you decide to put into different areas of the investment markets. A diversified portfolio will have representatives from the following: US Big Company Stocks, US Middle and Small Company Stocks, International Stocks, Bonds, and International investments.

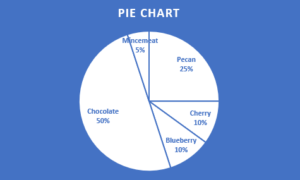

Asset Allocation usually is represented in a pie chart. Because everyone loves pie, even if they don’t love talking about investments! Like this:

Notice I used actual PIE instead of investments, so you couldn’t mistake this for investment advice!

Asset Allocation is said by many studies to represent 90% of the reasons your investments return what they return. Others dispute that, but let’s just agree that it’s super-important. If nothing else, starting your investment decisions with an asset allocation model can help you avoid some bonehead mistakes such as:

- Buying a bunch of investments that are all in the same asset class. Putting you at risk for huge losses when that area of the market doesn’t do well.

- Selling investments low and buying them high. Staying true to your asset allocation plan allows you to rebalance in a thoughtful way – not panic.

What’s the right asset mix (or allocation, if you must be fancy) for you? It depends largely on the time horizon you have for your investments and somewhat on your risk tolerance. Working with a financial advisor should help you find a good mix for your situation.