Here’s a shocking bit of news: College is way more expensive now than it was when I was an eager new CSU Ram in 1990. There aren’t many families that will get out of college without some sort of loans to pay back.

But how much is reasonable?

Private student loans are unlike any other borrowing. They seem to present no limits as to how much you borrow. A mortgage, car loan, home equity line of credit, credit cards – all of these debts have limits based on income, assets, or some ability to pay back the loan. Not so, student debt.

For an extreme example, read this article about people with over $1million in student debt. Yes, that is a thing. CLICK HERE.

A big problem is that parents don’t sit down with their kids and go over basic grown-up budgeting. This important exercise would help put potential student loan repayments into perspective, hopefully allowing students and parents to make wiser education buying choices.

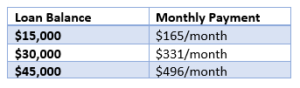

So, here are some quick tools to help you out. First, what will you owe on student debt? Based on a 10-year repayment period and 6% interest rate, here are some examples:

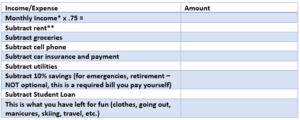

Okay, these numbers are probably given to the student up front, but does the 18-year-old know what a $496/month payment means? Here is another helpful tool I just made up. Feel free to modify.

*Look up average starting salaries for various degrees on http://www.themint.org/teens/starting-salaries.html

Multiply by .75 to account for taxes and benefits deductions

**Look up average rents in your area on this cool website:

https://www.zumper.com/research/average-rent

This exercise should not take more than an hour but will save so much regret and stress in the future.