When is contributing to an IRA not what your financial advisor (or CPA) advises? I’m so glad you asked! It’s very simple:

Most of you reading this should NOT be making tax-deferred IRA contributions. Why? Not all IRA contributions are deductible.

If neither you nor your spouse is covered by a workplace plan, your traditional IRA contribution is fully deductible regardless of income, up to the annual limit.

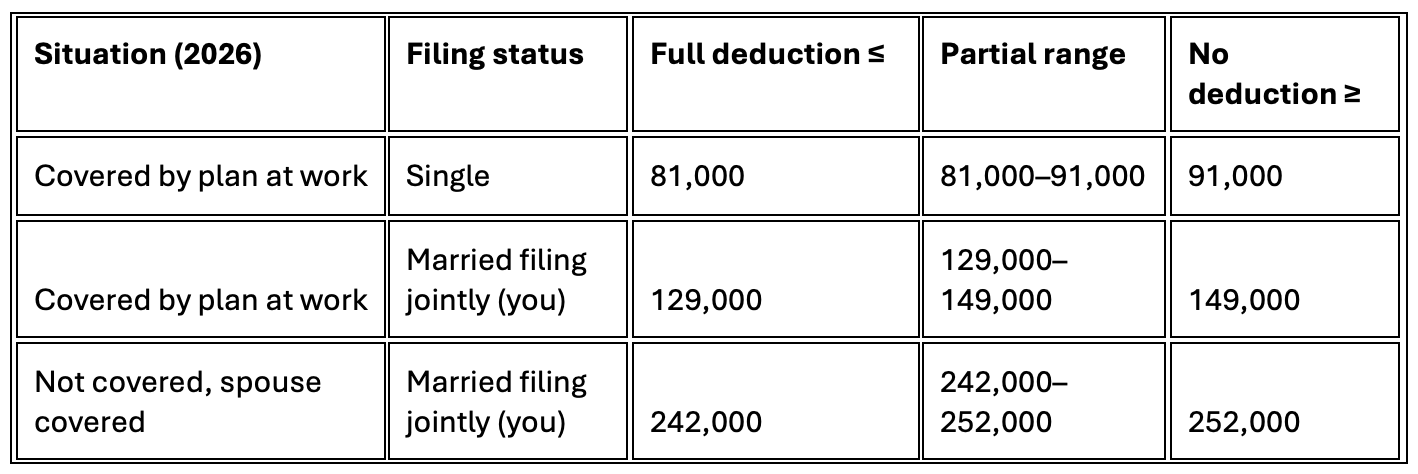

If you or your spouse is covered by a workplace retirement plan, your ability to deduct IRA contributions is limited by your modified adjusted gross income (MAGI). See the table below for details.

What happens if you have been making IRA contributions that aren’t deductible? Don’t worry, you won’t be thrown into tax jail. However, you are creating a bookkeeping nightmare if you want to avoid paying double taxes when you start withdrawing those assets in retirement.

Non-deductible IRA contributions have already been taxed. The growth that comes from those contributions grow tax-deferred. Also, the money that was already in the account (say, a rollover from a prior employer plan) is also tax-deferred.

When you go to withdraw from that IRA, you need to prove to the IRS – EVERY YEAR – that part of the money coming out is not subject to income tax because you already paid taxes on the contributions when they went in.

You are on the hook for tracking how much went into that account post-tax and applying an exclusion ratio (% of the account that is already taxed) to each withdrawal. For the rest of your life.

I am guessing most people just wind up paying income taxes on the full withdrawals without doing the extra math. That is why the non-deducted contributions are often double-taxed.

Have you been doing this because you were taught to always max out IRA contributions? You aren’t alone. Financial advice is often given without all of the nuances (looking at you, Suzy Orman).

This isn’t a huge problem, just a headache. Or an overpayment of taxes on a small portion of your retirement savings.

If you’ve been doing this, as Bob Newhart hilariously said on SNL, just stop it.