You may have noticed that I never offer any sort of stock market forecasts, or beginning of the year prognostications, or opinions on what will happen with inflation, or dire warnings about the bond market collapse in the next 6 months.

Why? Because I will never be right (unless by total lucky coincidence), and I don’t want to encourage my dear readers to start market timing.

However, one thing I am sure about is that the stock market does suffer losses sometimes. And in those times, many investors (not you of course, but feel free to forward this to your brother-in-law) get scared and sell their stock investments when they go down. And then, they wait until “things seem more stable” which is the classic sucker language for “the market has already gone back up a ton” and buy back in.

The way to make money investing is to buy low and sell high. The way most investors behave is to sell low and buy high. It’s not your fault. Your brain is hardwired to behave this way. I’m just trying to get ahead of your brain.

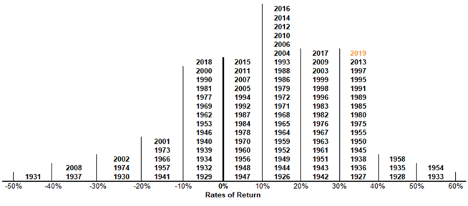

This blog serves as a friendly reminder that the stock market goes up in most years. Here is a graph, which by law a financial advisor is required to show at least once per quarter. Hey, it can’t all be dating advice.

This chart shows annual market returns from 1924-2019. The US large cap stock market lost money in 26 out of 95 years. 14 of those years were single digit losses. 69 years saw positive returns with 55 of those years being double digit gains.

You have a diversified portfolio, right? Not all of your money is in the S&P 500. You have some bonds, small cap stocks, real estate, international, etc. So, when one part of the market drops, you have some cushion with other investments.

Source: Russell Investments

Just a reminder from your friendly neighborhood financial advisor: Stock market losses happen. So do rebounds and extended gains. Whether the losses become a permanent problem for your finances is up to you.

Walk awaaayyyy from the computer…