There must be some physical component in the human brain that relentlessly drives us to compare our lives to that of our friends, enemies, co-workers, or ex-boyfriends. We do it with the cars we drive, the age we marry, our children’s’ SAT scores, and the granite on our countertops.

As a financial planner, I often get asked a question that goes something like this: “I’m 42 years old. Is the amount I have saved average or more or less than others my age?” In other words, am I keeping up with the 42 year old Jones’s?

My answer has always been that I don’t know. I don’t know enough 42 year old people that have taken the exact career path, earn about the same money, and have the same abilities as you. Really, a 42 year old neurosurgeon should have much more saved than a 42 year old teacher. Although you’d be surprised at how often that is not the case.

Thankfully, the fine people at Motley Fool and the US Census Bureau have provided some kind of an answer. And let me tell you, it is SCARY.

Check out this link to get the whole article: http://www.fool.com/investing/general/2015/01/26/the-average-americans-net-worth-by-ageheres-where.aspx

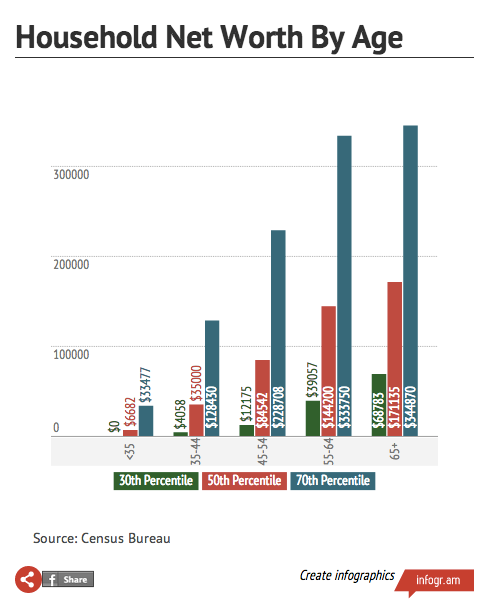

What this graph is telling you is that the best savers aged 65 and over in America have an average net worth of $344,000. That includes home equity.

Let’s say that the $344,000 was all invested in a moderate-risk portfolio and included no home equity. If you take the recommended 4% out of that account (the advised withdrawal rate for a retiree in their 60s), you get to take $13,760/year from investments if you hope to have the money last until your 90s. Add that to your Social Security benefit (average about $1,200/month according to Social Security) and there is your annual retirement budget. That means the annual retirement budget for the average American is $28,160. Yikes!

So, now my answer to the “are my savings above or below average” question will be this: You’d better hope your savings are WAY above the average, because if not, you are looking at a pretty skimpy budget in retirement.

Stay Informed and Educated — Subscribe to the SFP Blog! Use the quick and easy form to the right of this article.