To continue the theme – or maybe you call it a months’ long rant – about why Robinhood/Bitcoin/Reddit, etc. cloud the concepts of real, grown-up investing, I’d like to show an example of rates of return and life.

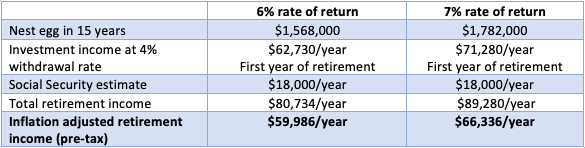

Scenario: Joe is 40 years old and has $500,000 saved for retirement. Good job, Joe! Joe plans to retire at age 65. He currently saves $15,000/year in his 401(k). His company does not match. Inflation is estimated at 2% throughout projection.

The extra rate of return provides Joe with about $6,350/year ($529/month) of retirement income. Not chump change; not enough to chase the latest investment craze, either. The return can be most controlled by being a calm investor, not by picking the “best” stock year after year. People who don’t sell low and buy high repeatedly – everyone does it at least once! – have better outcomes.

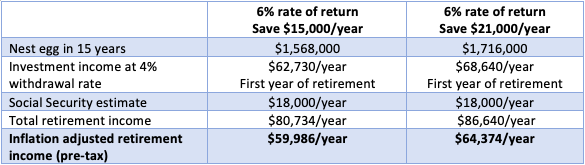

What you can really control is how much you save. Let’s look at Joe again, but change the variable from rate of return to how much he saves:

The extra $500/month savings doesn’t totally make up for the 1% lower return, but it’s close. The amount Joe saves is under his control, unlike market returns. Plus, if Joe saves the extra and gets a higher return, that’s gravy!

Before you let peer pressure goad you into an investment fad, please ask yourself WHY is this necessary? Weren’t you doing okay before these mad inventions? Won’t you continue to do okay without them?