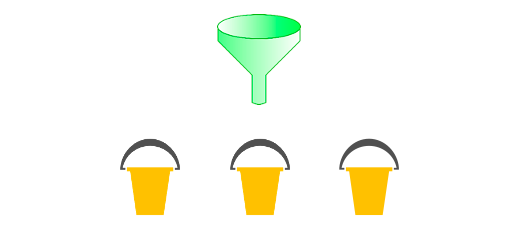

I think of creating retirement income plan in terms of funnels and buckets. The funnel is the decision-making process. The buckets are where your various accounts are placed and invested for income.

First, the funnel. Start wide at the top with the overall retirement projection. This informs how much you can safely spend in retirement and how much of that spending is coming from investments each year. It’s especially important to know the yearly withdrawal amounts in Years 1-5 of retirement to create your bucket system.

The narrower part of the funnel is where we decide the details. What are your values informing the withdrawal method choice? Is it to leave the most tax efficient inheritance? Or is it to have the least taxes during your own lifetime? Is it ease of administration for you? Or are you willing to spend extra time to beat the tax man at every turn?

Now the funnel has informed how we create the buckets. Bucket 1 will contain enough cash or CDs to cover 18-24 months expenses. You know exactly where the money is coming from to pay your monthly bills. No surprises, not much growth.

Bucket 2 contains bonds/CDs/Annuities – something fixed and predictable to refill Bucket 1 once per year. Bucket 2 can have Years 3-5 of retirement income.

Bucket 3 will have your longer term growth money. You can take more risk here, and you will need to. Your overall investments need to grow to keep up with inflation over time. You have a safety buffer built in for the first 5 years of retirement (more, if you choose larger amounts in Buckets 1 and 2).

In good years, you’ll take your profits and invest to refill Bucket 2. In down years, you can wait to pull from Bucket 3 because you have plenty to see you through in Buckets 1 and 2.

From here, you will decide which accounts fill each buckets. Those accounts are then invested according to their new place in your withdrawal timeline.

Sounds easy, right? Well, it’s not rocket surgery or brain science, but this exercise does take time and maybe a little distance. You are rethinking everything you thought about money. Saving is so much different than withdrawing.

Here is where a professional can help. Whether your financial advisor charges you annually to manage assets or you are using a fee-for-advice model like mine, now is the time to be REALLY in touch with that advisor to plot your retirement paycheck strategy.

Contact me if you would like help creating your retirement income plan.