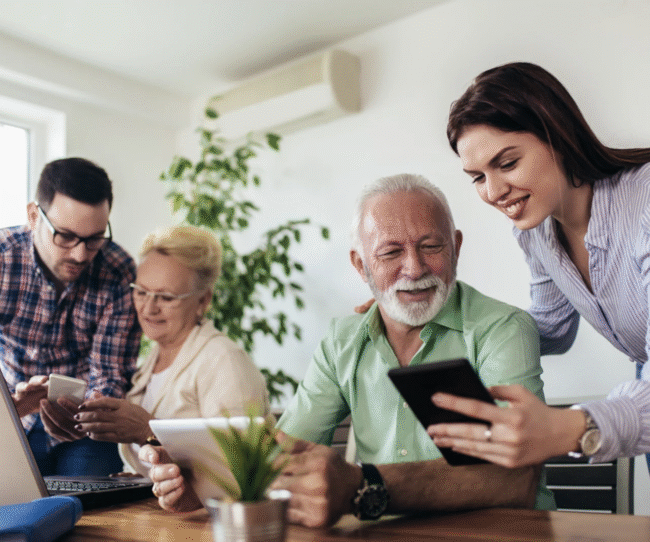

Should You Involve Adult Kids in Your Retirement Planning?

Occasionally people ask if they should have their adult children sit in on their retirement planning appointments. While I am all for meeting the whole family, the answer to this question depends on your situation. For some, letting Junior know that there is wealth at the end of the parental life rainbow might leave them…